Navigating Education Savings in a Volatile Market

April 9, 2025 - 21:44

If you have an education savings account and a kid heading to college, you may be hesitant to check your balance. The recent downturn in the market has left many parents feeling anxious about their investment in a 529 plan. However, it’s crucial to remember that market fluctuations are a natural part of investing, especially for long-term goals like education.

Instead of panicking, focus on the fundamentals of managing your education savings. First, assess your investment strategy. Diversification can help mitigate risks, so consider spreading your investments across various asset classes. If you haven't already, consult with a financial advisor who specializes in education savings to ensure your portfolio aligns with your risk tolerance and time horizon.

Additionally, consider making regular contributions, even during market downturns. Dollar-cost averaging can help you take advantage of lower prices and build your savings over time. Lastly, keep in mind that education is a long-term investment, and staying the course can often yield positive results in the long run.

MORE NEWS

February 24, 2026 - 01:38

NYC public schools to reopen for in-person learning TuesdayNew York City`s public school system will resume in-person instruction on Tuesday, following a classic snow day closure that allowed students to enjoy a winter respite. The decision to close on...

February 23, 2026 - 07:34

Ministers say billions in SEND funding will make schools more inclusiveA significant new funding package, running into the billions, has been unveiled with the aim of creating a more inclusive school system across the country. Ministers state the investment marks a...

February 22, 2026 - 21:19

Riverside plans takeoff of aviation education initiative at airportA major new initiative is taking flight in Riverside, aiming to transform the local airport into a central hub for aviation education and career training. The collaborative effort unites the city,...

February 22, 2026 - 02:23

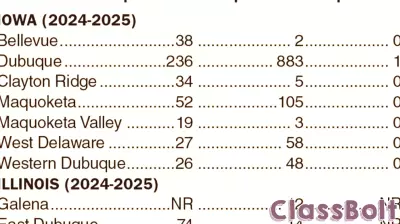

Area districts focus on education, safety when using suspensions, expulsionsA recent school board meeting highlighted a growing, sober reflection on student discipline. Educational leaders are increasingly prioritizing supportive interventions over traditional punitive...